Getting a feel for how much customers could owe the company on credit at the end of the year helps a company project sales, expenses and cash flow needs, among other financial metrics. The percentage of sales method definition refers to businesses’ forecasting tools to predict multiple liabilities, expenses, and assets based on their sales data. This forecasting model enables organizations to prepare accurate budgets and take informed financial decisions. It connects a company’s sales data to income accounts and balance sheets.

I Created This Step-By-Step Guide to Using Regression Analysis to Forecast Sales

Keep in mind that it makes sense to use this method only for items that you know are directly related to the Sales value. If you cannot trace this relationship, it makes no sense to make the calculation based on this number. Because the percentage-of-sales method works closely with data from sales items, it’s not the best forecasting method for things like fixed assets or expenses. The common size percentages help to highlight any consistency in the numbers over time–whether those trends are positive or negative.

Formula

Once the sales growth has been determined, the company can prepare pro-forma, or forecasted financial statements. For most businesses, especially in retail, owners and managers like to know the percentages of increase and decrease for just about everything, from sales to salaries. Management and external users use this method to analyze the performance of the company and identify key indicators of improvement or signs the company might be in trouble over time. For instance, creditors might compare interest expense to sales to identify whether the company is able to service its debt. If interest expense rises in relation to sales each year, creditors might assume the company isn’t able to support its operations with current cash flows and need to take out extra loans. This is not a good sign, but keep in mind this method is a starting point for financial statement analysis.

Improve the percentage-of-sales forecasting with accounts receivable to sales ratio

This means that 44% of our sales revenue is tied up in Accounts Receivable. You can expect to have roughly the same amount of Accounts Receivable next year, unless specific measures are taken, for example, to reduce this amount. Financial forecasting is the study and determination of possible ways for the development of enterprise finances in the future. Financial forecasting, like financial planning, is based on financial analysis. Unlike financial planning, the forecast is based not only on reliable data but also on certain assumptions.

Determine your estimated growth and most recent annual sales figures.

Although the method cannot provide accurate figures, it still offers businesses an effective way to understand their short-term future from a financial standpoint. The forecast, or pro-forma, balance sheet will not balance initially; that is, total assets will not equal total liabilities and owner’s equity. The difference represents the amount of external financing that must be obtained to finance the increase in sales. The percentage of sales method is a financial forecasting method that businesses use to predict their sales growth on an annual basis. They use this information to predict the amount of financing they need to acquire to help accomplish their goal. Those percentages are then applied to future sales estimates to project each line item’s future value.

Which of these is most important for your financial advisor to have?

These drawbacks show why other financial forecasting techniques are needed. Profitability ratios, for example, are an excellent tool for this is how xero bacs payments work a more detailed and accurate financial forecast. First, it is a quick and easy way to develop a forecast within a short period of time.

The old data won’t take into account any big new changes so the results wouldn’t be particularly useful. So it’s not just a nice-to-have in your financial arsenal—it’s a necessity. Connect and map data from your tech stack, including your ERP, CRM, HRIS, business intelligence, and more.

- You might want to find out what percentage of Sales is your company’s Cost of Goods Sold.

- Let us look at his percentage of sales method calculation example to understand the concept better.

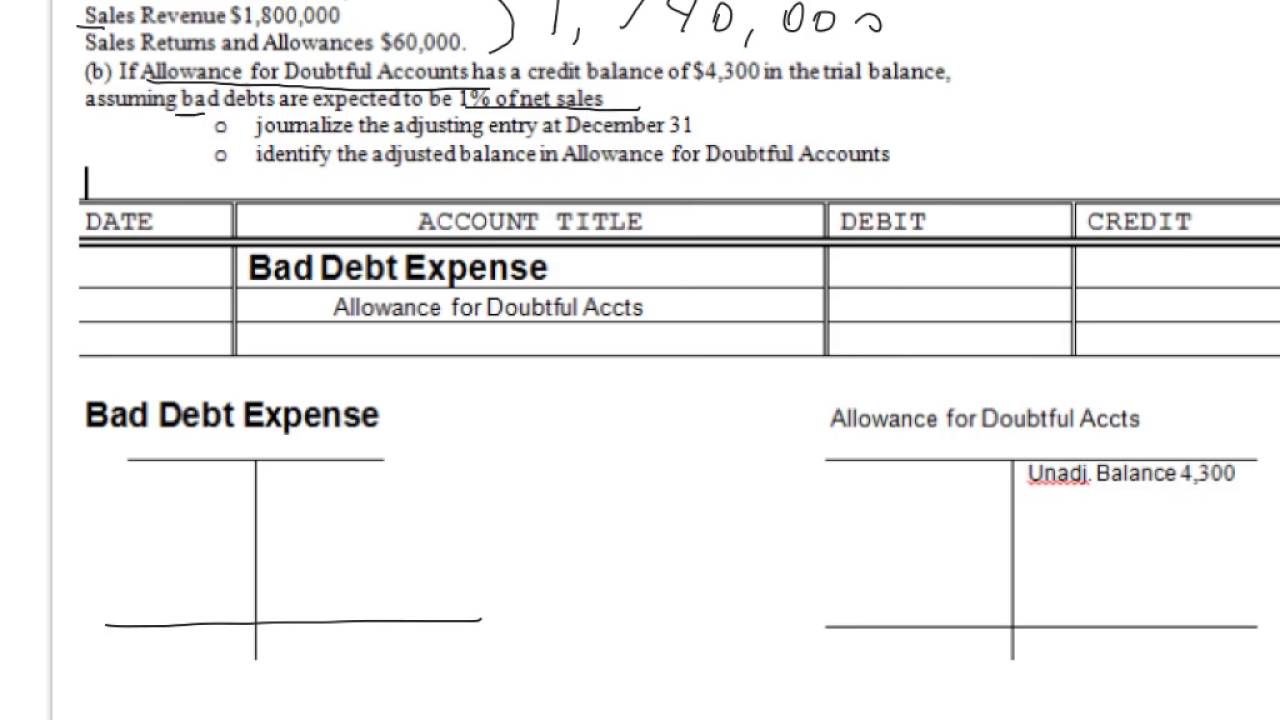

- Bad debt expense represents the money that customers owe but are unlikely to pay.

- 11 Financial is a registered investment adviser located in Lufkin, Texas.

- Say Jim runs a retail running shoe store, and has the following line items he wants to forecast.

- Identify which financial elements to track along with your sales numbers.

The common size percentages are calculated to show each line item as a percentage of the standard figure or revenue. The percentage-of-sales method is used to develop a budgeted set of financial statements. Once all of the amounts have been determined, Mr. Weaver can put this information into his forecasted, or pro-forma, income statement and balance sheet.

Over the past three years, the company found that its marketing expenses averaged 8% of total sales, while its operating expenses averaged 12%. Joist helps manage sales, streamline operations, and create detailed estimates and invoices. These capabilities contribute to a clearer understanding of your financial situation. While COGS is generally related to sales, it might not directly correspond to changes in sales volume. This could happen because of factors like inventory accounting methods or changes in material costs. In this article, we’ll explain the percentage of sales method and how to calculate it.